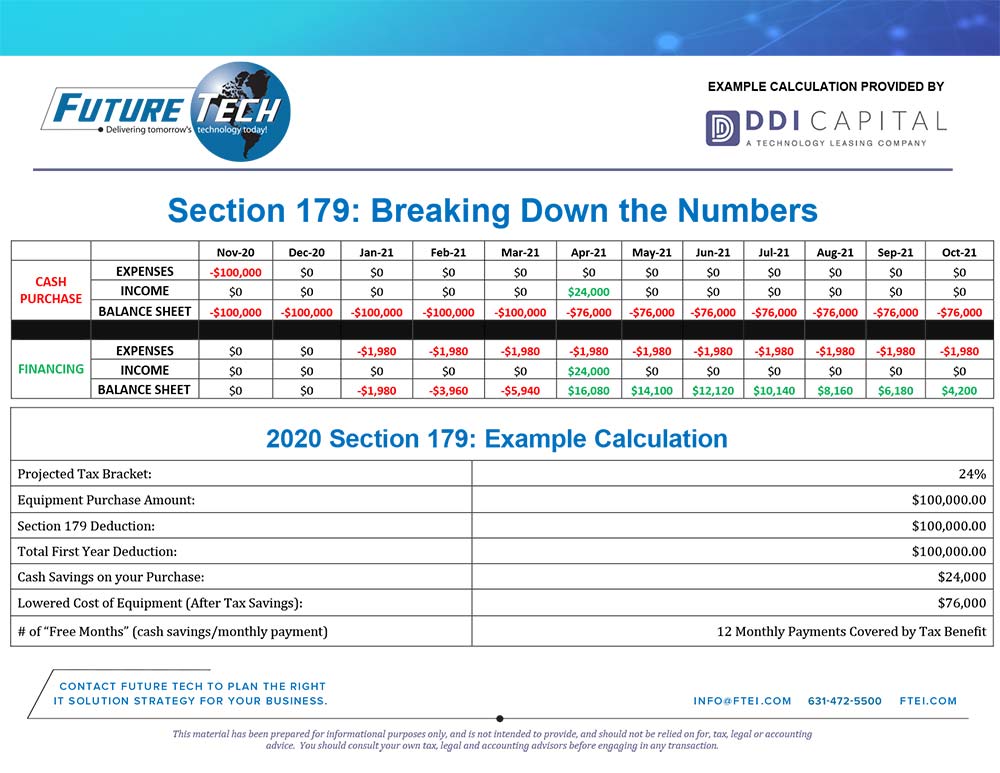

Section 179 is an IRS tax code that allows businesses to deduct the full purchase price of equipment or software which is purchased or financed this tax year. It is an incentive created by the U.S. government to encourage businesses to invest in themselves.

Why does it matter?

When you buy or lease equipment, you can deduct the full purchase price from gross income, saving you significant tax dollars.

What is the limit?

The deduction limit for 2020 is $1,040,000.

Act Now

See Section 179 sample calculation info below. For additional information on this program, or any of the other cost saving initiatives Future Tech offers, please contact us.